Subject to change without notice. 2 Up to $5 million CAD. Maximum $25,000 for all Emergency Medical Insurance benefits for Canadian residents without active Government Health Insurance Plan (GHIP); and/or without GHIP authorization to cover trip days in excess of 212 days in Ontario in a 12-month period. 3 To have your pre-existing medical.. Let's get you connected with your Club . Services are different depending on where you live in Canada. Select your region and we will direct you to your CAA Club site.

Mammy’s got a new whisk 🍆😂 no need for a health insurance xx Mrs Brown's Boys

Does Group Health Insurance Cover Pre Existing Conditions?

The Travel Insurance You Could Be Missing CAA South Central Ontario

Learn More about CAA Travel Insurance YouTube

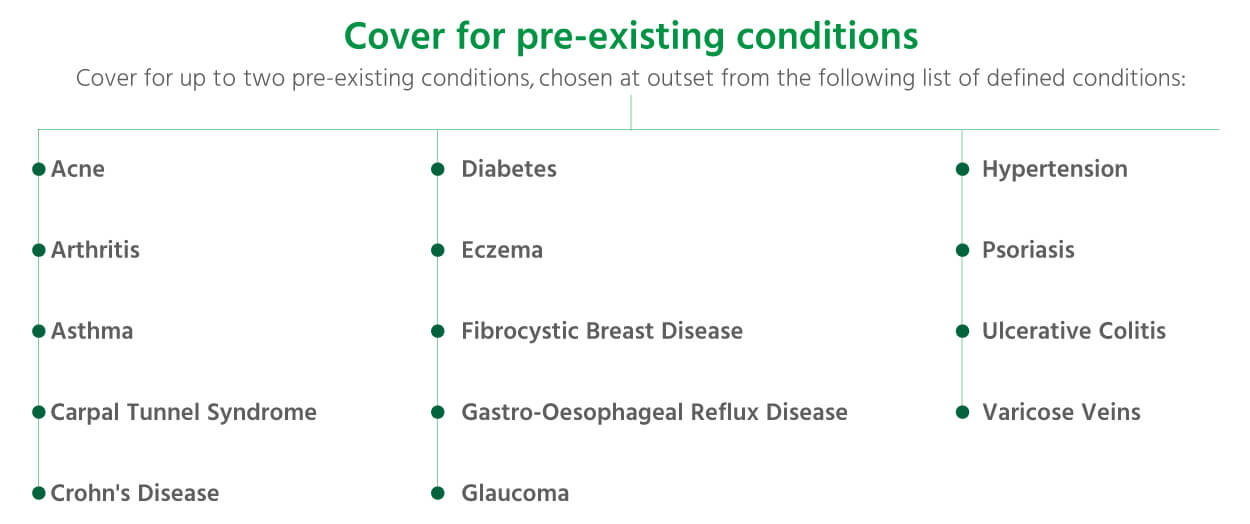

Preexisting Medical Conditions Cover Private Health Insurance

Member Travel Benefits CAA Niagara

PreExisting Conditions Insurance Plans for US Visitors

Travel Medical Insurance CAA Niagara

Pet Insurance That Covers PreExisting Conditions (2023)

FAQ Health Insurance & PreExisting Conditions YouTube

Travel insurance pre existing conditions Well Zapness

CAA Insurance Member Savings and Benefits Preferred Insurance

My CAA Insurance CAA Member benefits, Auto, Home & Travel Insurance caa basic membership,

PreExisting Conditions Insurance Plans for US Visitors

CAA Travel Insurance Vector Logo Free Download (.SVG + .PNG) format

Buy CAA Travel Insurance When You Book Your Trip YouTube

Preexisting Condition Insurance

CAA Travel Insurance upgrades coverage ITIJ

What are travel insurance pre existing conditions? Insurance Business America

Pet Insurance And PreExisting Conditions What You Need To Know

CAA Travel Insurance EducateMe. Travel safe and travel smart with everything you need to know about vacation planning, travel insurance and the latest travel advice and advisories. Call 1-800-437-8541 for questions. Travel Insurance FAQs. Checklist and helpful tips.. 8 Multi-Trip Vacation Package Plan covers 4, 8, 15, or 30 days per trip depending on the plan purchased. Top-Up coverage is available for longer trips. Coverage cannot exceed 365 days from departure date or effective date. There is a maximum travel coverage of 63 days including Top-Up for travellers aged 60 to 84 years of age. Compare CAA.