To be eligible for the Flat Rate VAT Scheme, a business's VAT taxable turnover must be £150,000 or less. It's essential to note that this figure refers to the expected turnover for the next year, not the past year. If during the year, your turnover exceeds £230,000 (including VAT), you'll need to exit the scheme.. Simply put, if your customers are not VAT registered businesses then your prices will be more expensive if you add VAT on. For example, if you previously sold pizzas for £10, as a VAT registered business you must pay HMRC 20% VAT on your sales, so to suddenly increase your prices to £12 per pizza will have an impact on the volume of your sales.

Avoid paying VAT when you Export; Import and Export in Italy YouTube

Claiming VAT Back on a Commercial Property Purchase BloomSmith

Tips To Avoid Paying PMI Tom Stark Mortgage Team

Is Vat Applicable On Commercial Rent

How Do You Avoid Paying VAT on a Yacht? Guide 2023

How to Avoid Paying VAT on Prototypes Imported to the UK

Orange Order puts Scottish HQ up for sale after bosses 'tried to avoid paying VAT' The

How to avoid paying import duty and VAT when importing to the UK. Your complete and easy guide

tax news avoid paying VAT twice!

WH Smith continues to demand boarding passes from passengers to avoid paying VAT The

3 Ways Businesses Can Avoid Paying VAT In The UAE

Claiming a Tax Treaty Benefit in a Foreign Country or Want to avoid Paying VAT? Make Sure You

Stop paying VAT (legally) that makes you poor. How to legally avoid paying VAT. YouTube

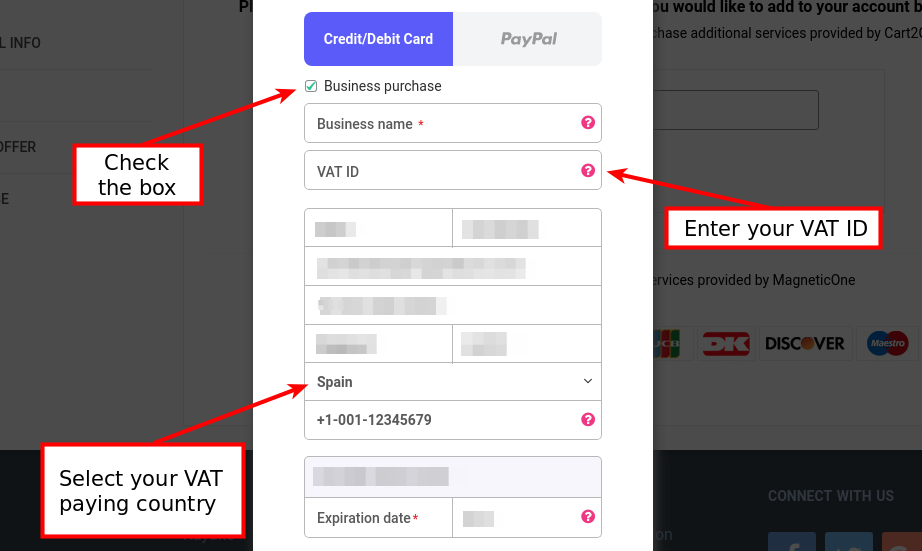

How to avoid paying VAT? Cart2Cart FAQ

How to avoid paying £130,000 in VAT registration fees if you export to EU Small Business UK

5 simple VAT mistakes to avoid Fortus

Splitting business to avoid paying VAT Mazuma

Is Vat Applicable On Commercial Rent

Where do stores buy their products? 2024

How Do You Avoid Paying VAT on a Yacht? Guide 2023

For example, if you purchase a pair of shoes for $100, and the value-added tax rate is 20%, you would pay $20 in VAT at the register when you pay for the shoes. The value-added tax rate varies by.. The idea of a value-added tax (VAT) is a foreign concept to most Americans. That puts us in the minority, though: VAT, a multi-layered tax applied at each stage of the manufacturing and marketing.