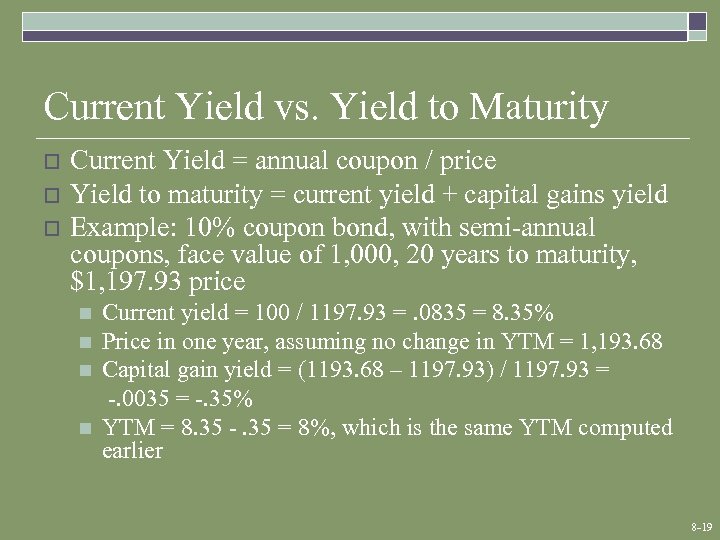

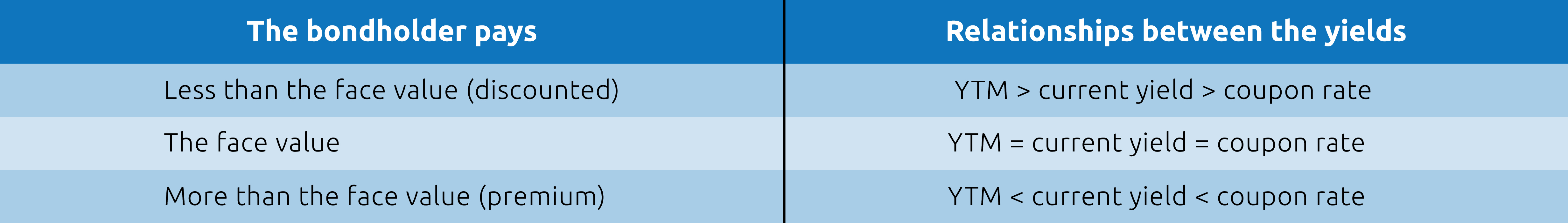

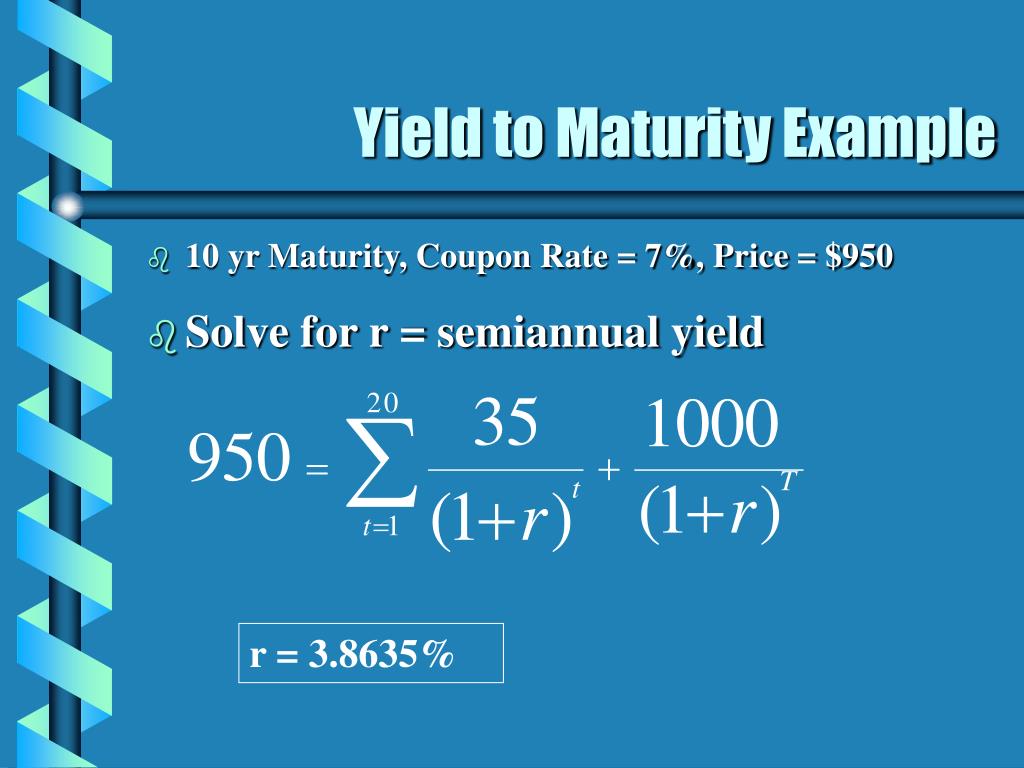

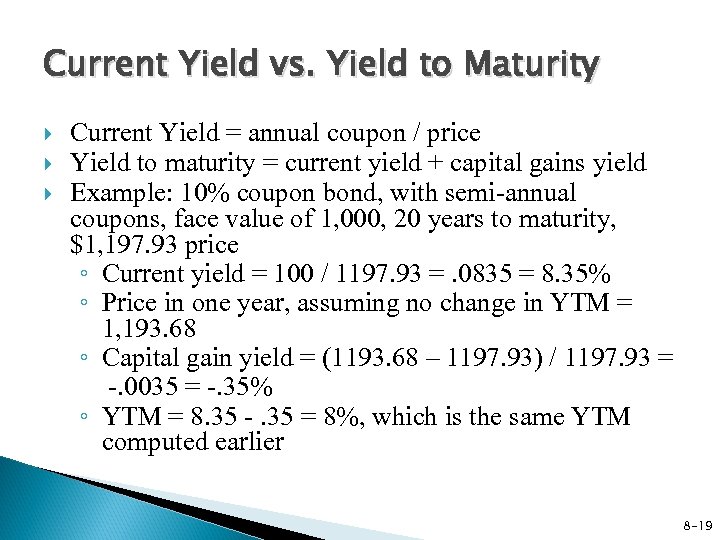

A bond's yield is measured in different ways. Two common yields that investors look at are current yield and yield to maturity. Current yield is a snapshot of the bond's annual rate of return, while yield to maturity looks at the bond over its term from the date of purchase.. Running Yield: The annual income on an investment divided by its current market value . Running yield is a calculation that takes the income from dividends (for stocks) or coupons (for bonds) and.

:max_bytes(150000):strip_icc()/Term-Definitions_yieldtomaturity_FINAL-bbbebc60d39345e9b5be26e89e8cb62f.png)

Yield to Maturity (YTM) What It Is, Why It Matters, Formula

What is the yield curve? Definition and examples Market Business News

Chapter 8 7 Interest Rates and Bond Valuation

PPT Chapter 10 PowerPoint Presentation, free download ID5651313

Yield to Maturity Calculator Calculate YTM for Bonds Inch Calculator

Coupon Rate vs Current Yield vs Yield to Maturity (YTM) Explained with Example YouTube

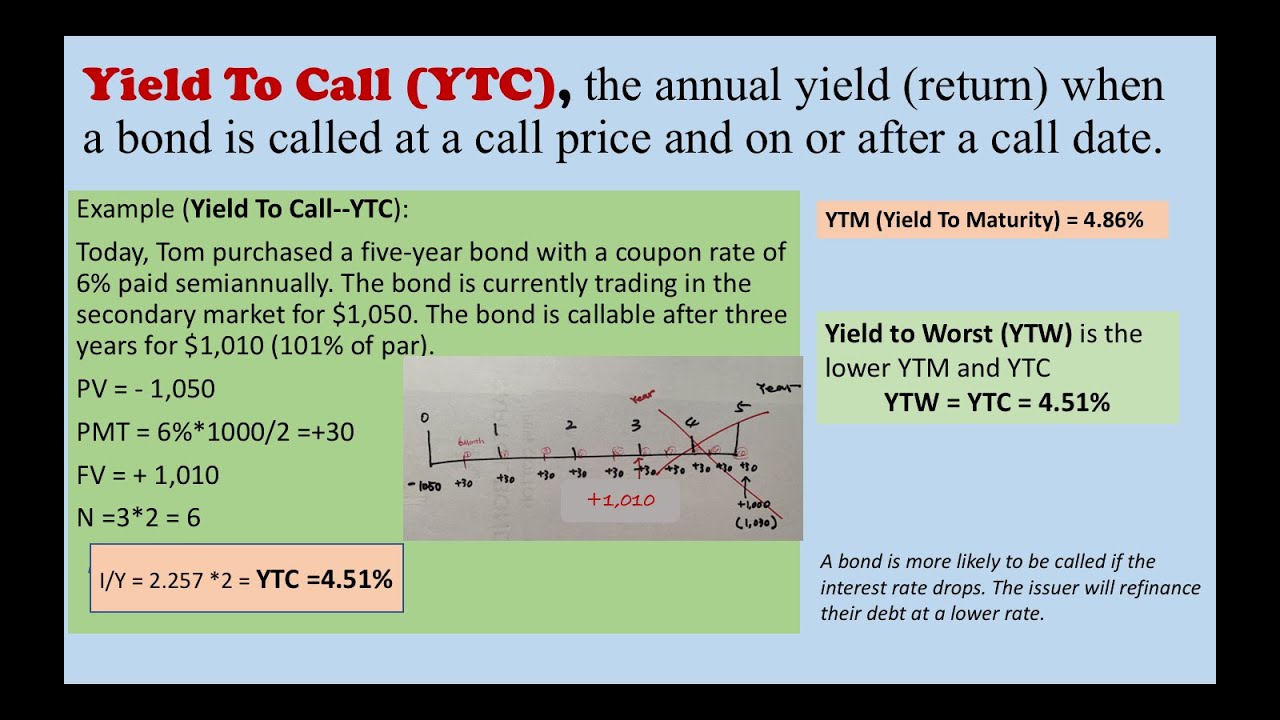

What are Yield To Call (YTC) and the Yield To Worst (YTW)? YouTube

Yield To Maturity (YTM) What is YTM, Calculator & Formula Nippon India Mutual Fund

PPT Bonds PowerPoint Presentation, free download ID1746969

Yield To Worst What It Is And Why It's Important

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Formule Yield To Maturity Formule

The Yield Curve What is it, and why does it matter? Finite

Yield to Maturity Versus Rate of Return YouTube

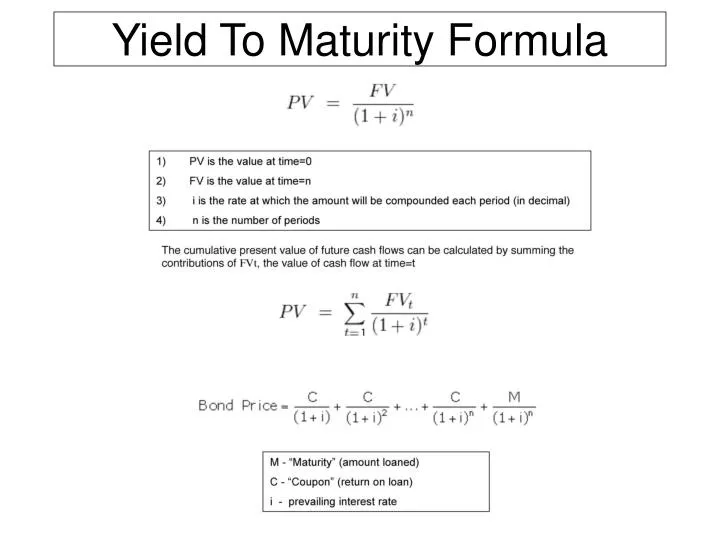

PPT Yield To Maturity Formula PowerPoint Presentation, free download ID2938012

Solved Current Yield vs. Yield to Maturity Current Yield =

Chapter 8 Interest Rates and Bond Valuation

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-02-10d2adc981ea475eb2165a5ec13082ed.jpg)

Current yield vs yield to maturity

PPT Chapter 12 Bond Prices and the Importance of Duration PowerPoint Presentation ID434237

Yield to Maturity vs. Discount Rate What's The Difference (With Table)

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current yield vs yield to maturity

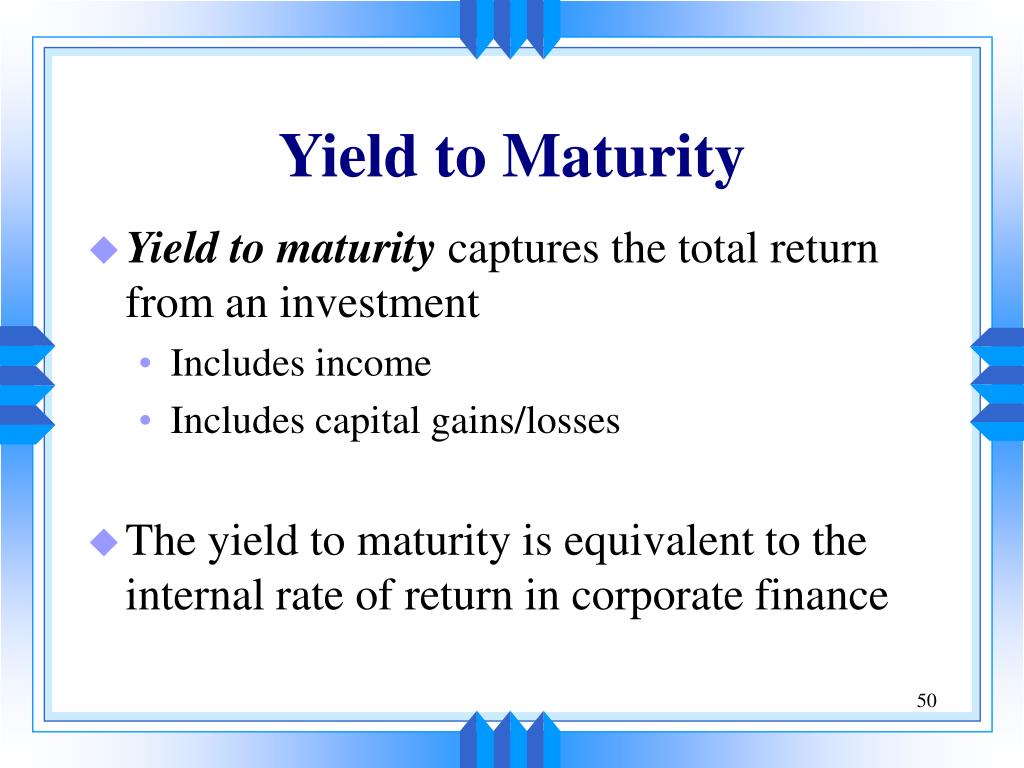

However, if a bond is trading at a premium the yield to maturity will be the running yield LESS the annualised capital loss being the difference between the current market price and $100 face value that will be returned upon maturity and adjusted for discounting. For example, the Qantas fixed rate bond currently has a nominal yield of 6.5%, a.. Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate.