How to transfer. Form APSS 263 tells you what information you'll need to provide before making a transfer. Download and fill in the form and give it to your UK pension scheme administrator. Your.. Jason O'Connell is a Level 6 UK pension transfer & planning advice accredited pension transfer specialist - one of the very few advisers in Australia holding this accreditation. The reason for this change was because the FCA believes it is usually unlikely to be in the member's best interests to forgo a fixed and safeguarded retirement benefit.

How the UK Pension Transfer Process works » UK Pension Transfers

Pension Transfers UK Pension Help

How To Transfer Uk Pension To Australia? Retire Gen Z

Transfer UK Pension to Australia UK Pension in Australia

What is a Pension Transfer? UK Pension Help

Australia can transfer UK pension to selfinvested pension. Why wait? Matthew Davis posted on

How can I transfer my pension? CountryWideAssured

Tips To Transfer UK Pension To Australia

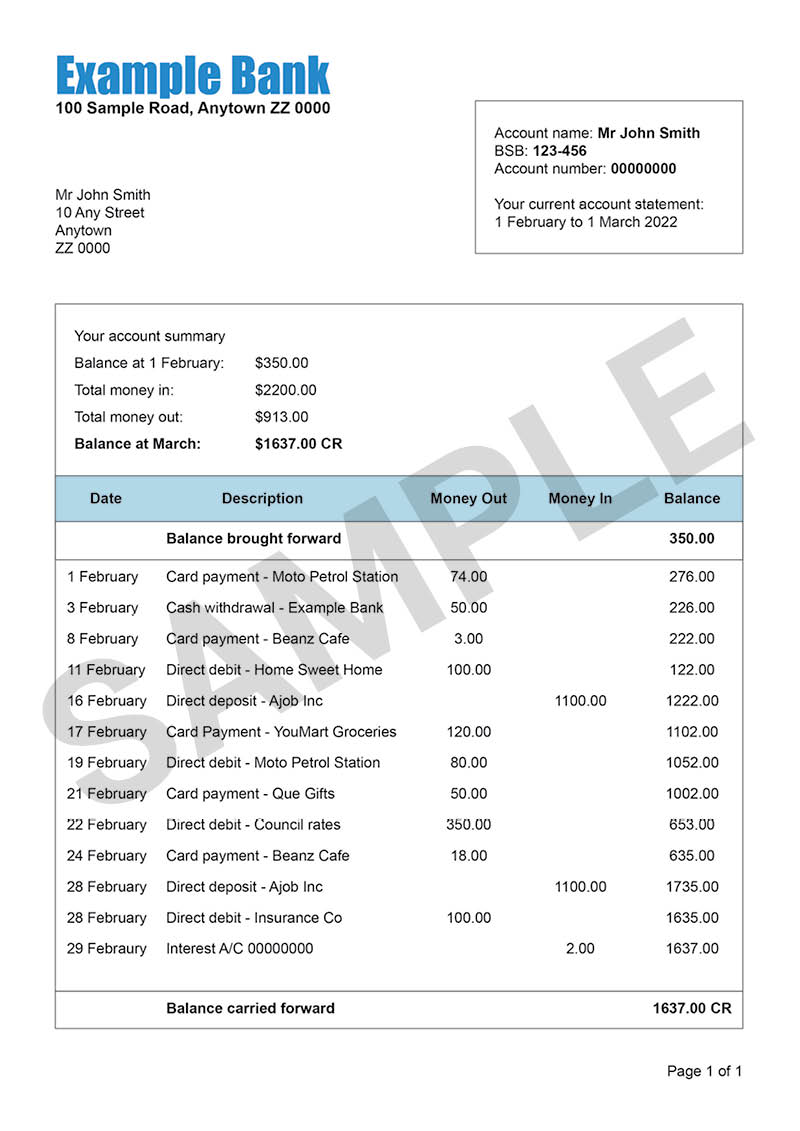

Supporting documents for Age Pension Age Pension Services Australia

UK Pension Transfer Pension Plus

Transfer your Existing UK Pension to Australia YouTube

How To Transfer Uk Pension To Australia? Retire Gen Z

How To Transfer Uk Pension To Australia? Retire Gen Z

How To Transfer Uk Pension To Australia? Retire Gen Z

How do I transfer my pension to Australia Hoxton Capital Management

Is a UK Pension transfer for you? » UK Pension Transfers

UK Pension to Australia Tax Considerations Murphy Tax Lawyers & Advisors

Transfer UK Pension to Canada RRSP Harrison Brook

How To Transfer Uk Pension To Australia? Retire Gen Z

/uk-pension-pounds-536776681-9a6fa1a81ec449e786a197df0b857f4c.jpg)

SelfInvested Personal Pension (SIPP)

Apply online to the HMRC to have your SMSF registered as a QROPS. Note that there are ongoing HRMC reporting obligations involved with being a QROPS. The HMRC approval process typically takes up to eight weeks. Step 6. Once your SMSF is registered as a QROPS, apply online to have your UK pension funds transferred.. By transferring your full UK pension to an Australian super, you avoid that risk. For advantageous tax treatment. It's likely you'll have benefited from advantageous tax treatment on UK contributions in the form of tax relief at your marginal rate. When you come to take your pension, 25% will be tax-free but you'll pay Income Tax on the rest.